The Federal Law No (7) of 2017 on tax procedures specifies the appointment of a tax agent to represent taxable persons before the Federal tax authority (FTA) with regards to his tax affairs and taxable obligations. Federal Law No. (7) of 2017 on Tax Procedures states tax agents as:

“Any Person registered with the Authority within the Register, who is appointed on behalf of another person to represent him before the Authority and assist him within the fulfillment of his Tax obligations and therefore the exercise of his associated tax rights ”. it’ll not be always possible for the businesses to appear after the problems on tax matters and resolve it with the concerned authority (FTA) by itself. it’s necessary for companies to appoint an expert to handle tax matters and to act on their behalf for all matters referring to the UAE TAX.

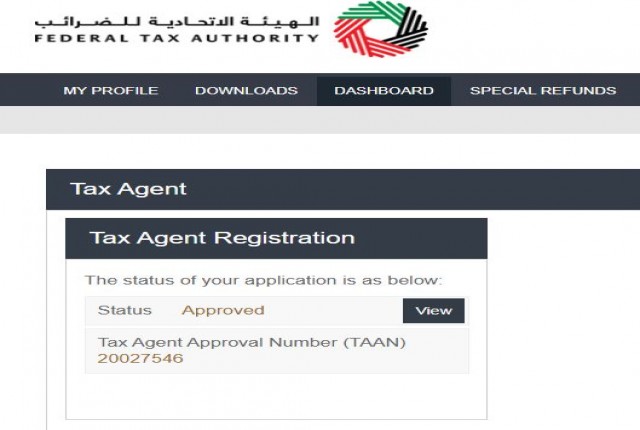

It is prohibited to practice the profession of a Tax Agent without completing the registration and receiving accreditation from the FTA. Doing so constitutes a legal offense. ARC Associates is now one of the registered tax agency within the UAE to serve the businessmen better, with TAX Agent Name as Adil Amin Al Mulla Holding TAN 20027546.

UAE tax regulations are constantly changing. Our tax experts can provide structuring advice taking into consideration corporate tax issues and any structuring implications referring to direct and indirect taxes. Being one in all the simplest TAX Agency in UAE we help our clients in the following ways:

Contact us for Tax Advisory Services, VAT Implementation Services, VAT Return Filing, VAT Compliance Review, and Tax Consultancy Services, Tax Agent Services & TAX Audit Services.

TAX Agent in UAE | VAT Consultants in UAE | VAT Agent in UAE | TAX Consultants in UAE